What is a BCG Matrix and How Does it Work?

A BCG matrix aids companies in analyzing their industry’s present and potential competitive landscapes and then planning accordingly.

Business models are focused on delivering profitable goods or services now, as well as identifying improvements in offerings that will keep the business profitable in the future. The latest moneymakers are obvious now, but a sound business plan still considers the future.

The BCG matrix, also known as the Boston or growth-share matrix was created by the Boston consulting group matrix and offers a strategy for assessing goods based on growth and relative market share. Since 1968, the BCG model has been used to help businesses understand which products can better help them leverage on market share growth opportunities and gain a competitive advantage.

Putting together the matrix

To evaluate your own company, you’ll need data on your products or services’ relative market share and growth rate.

When analyzing market growth, you can objectively evaluate your competitive advantage over your largest competitor and plan for three years of growth. If the market is highly fragmented, however, absolute market share can be used instead.

You can then either draw a Boston consulting matrix or use an online BCG matrix template program. Many are either free, subscription-based, or part of another charting service, such as Miro’s free one.

Place each of your goods in the box that corresponds to their market share and growth. The position of the dividing line between each quadrant is determined in part by how your business stacks up against the competition.

Also Read: Business Research Steps with Example

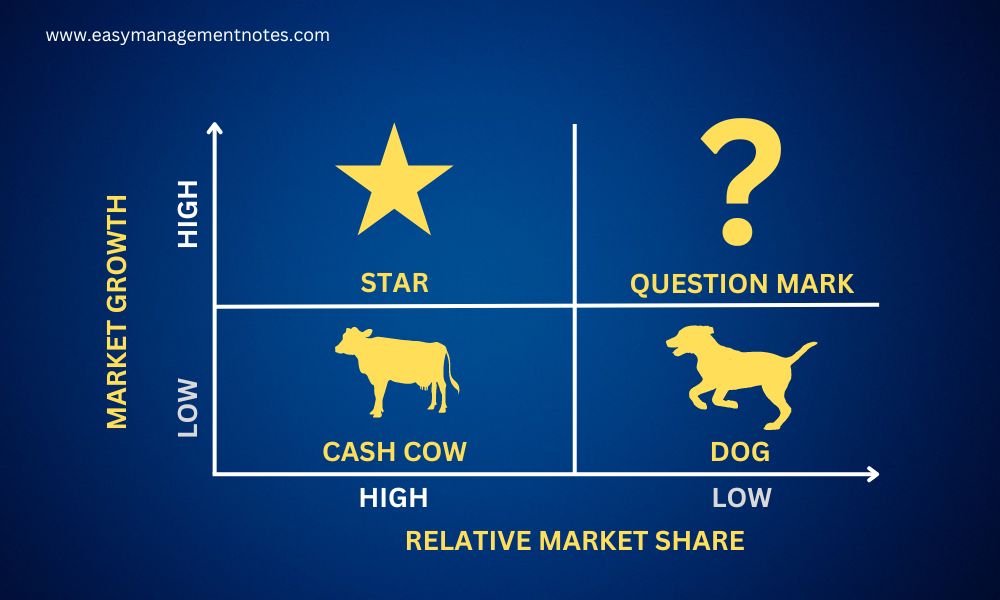

The following is a breakdown of each quadrant of the BCG matrix:

- Stars: Corporate divisions or goods with the highest market share and revenue are referred to as stars. Stars are also used to describe monopolies and first-to-market goods. In most cases, this means that the amount of money coming in equals the amount going out. If stars can maintain their momentum once a high-growth market slows down, they can gradually become cash cows.

- Cash Cows: A cash cow is a market leader that produces more money than it absorbs. Cash cows, according to NetMBA, include the cash needed to turn a question mark into a market leader, cover the company’s operating expenses, finance R&D, service corporate debt, and pay dividends to shareholders. Companies are encouraged to invest in cash cows to sustain current productivity levels or to passively “milk” the profits.

- Dogs: Dogs, or pets as they are also known, are units or items with a small market share and a slow growth rate. Dogs are commonly referred to as “cash traps” because companies invest money in them even though they get nothing in return. These divisions are excellent candidates for sale.

- Question Marks: These parts of a company have a lot of growth potential, but they have a small market share. They spend a lot of money but give back so little. Question marks lose money in the end. If a product has the potential for success, companies should invest in question marks; if it does not, they should sell.

Strategizing for the BCG matrix

- You can critically analyze each business unit or product now that you know where they stand.

- To increase a product’s market share, increase investment in it. You can, for example, transform a question mark into a star, and then into a cash cow.

- If you can’t afford to put more money into a commodity, keep it in the same quadrant and ignore it.

- Reduce your investment and strive to extract as much cash as possible from the commodity to boost its overall profitability (best for cash cows).

- Release the funds that have been stranded in the business (best for dogs).

- To maintain a stable cash flow and have goods that can protect your future, you need products in each quadrant of your BGC matrix.

Cash flow’s place in the BCG matrix

To get the most out of the BCG matrix, you must first understand cash flow:

- Market share affects profit margins and cash flow. High margins and a large market share go hand in hand.

- You must invest in your assets to expand. Growth rates determine the additional cash needed to keep a share.

- Market share must be won or purchased. Purchasing market share necessitates a further investment or increment.

- No product demand will continue to expand indefinitely. When growth slows, you must take advantage of the opportunity; if you wait too long, you will miss out. The payoff is money that can’t be put back into the product.

- The last point is much more important now than it has ever been. The market now moves at a faster pace than it did 40 years ago, and BCG has since published recommended revisions for analyzing and acting on matrix data.

- Keeping a healthy supply of question marks on hand prepares you to jump on the next big thing. Cash cows, on the other hand, must be milked efficiently because they are more likely to fall out of favor – and profitability – sooner. More methods can be found on BCG’s website.

An example of a BCG matrix in real life

Looking at a real-life BCG matrix example and then sharing the matrix with your team will help you understand BCG-based development. Coca-Cola, which owns a lot more drinks than just its name brand, is a typical BCG matrix example.

Diet Coke and Minute Maid are question marks in the Coca-Cola BCG matrix, as these brands have a small following but plenty of space to expand. Kinley and Dasani, two of its bottled water brands, are stars because they dominate the market in Europe and the United States, respectively, and display no signs of slowing down.

Coca-own Cola’s drink is a cash cow because, despite its high market share, it grows slowly, a classification that makes sense considering the company’s ubiquity among soft drinks. Coca-Cola, on the other hand, is a dog, since legislation prohibiting soft beverages – not to mention public opinion against them – has reduced soda sales. The real-life BCG matrix example from Coca-Cola demonstrates an important point: A commodity may often be classified as belonging to more than one group.

Another viewpoint as an alternative

The BCG matrix is a great tool, but it isn’t right for every company. Some businesses discover that they don’t have products in each quadrant, nor do they have consistent movement of products between quadrants as their product life cycle progresses.

Instead, some consultants recommend using the GE/McKinsey matrix, which provides more categorization choices and calculates goods based on business unit strength and sector attractiveness rather than market share, which can be difficult to manage. Comparing the two models will uncover secret insights that will help the company grow faster.

BCG Matrix’s Limitations

The BCG Matrix creates a structure for allocating resources to various business units and allows for quick comparisons of multiple business units. However, there are some drawbacks to BCG Matrix, such as:

- Businesses are classified as low or high in the BCG matrix, but they may also be classified as medium. As a result, the true essence of business can be obscured.

- In this model, the market is not specified.

- With a large market share, there are also high costs.

- Dogs may also assist other companies in achieving a competitive advantage. They can often reap even more than cash cows.

- The four-celled approach is thought to be overly simplistic.

How do you use BCG Matrix for added performance?

BCG Matrix is an effective tool to enhance your business performance by improving resource allocation and adding to effective decision-making. It is this tool that helps you strategize and prioritize your products in a way that maximizes your profits and minimizes your losses.

Here is the step-by-step guide using which you can strategize and streamline your business by using BCG Matrix:

1. Finalize a specific business unit or product.

The very first step involves identifying the business unit or product that you wish to evaluate with the BCG Matrix. You can do that by systematically analyzing your overall business. You will need to keep other factors in mind, such as particular product lines, specific brands that you own, etc. Variables like competition, position, market, industry etc., keep differing based on what you wish to evaluate in the BCG Matrix.

2. Determine your industry or market.

Now that you know which product or unit you wish to analyze, the next step involves pinpointing the industry or market to which the former belongs. It is not possible to create an effective BCG Matrix without considering this data. The inability to classify a product’s niche or industry can lead to inaccurate results, which will adversely affect your business decisions. ‘

For example, if you misclassify a luxury product as an ordinary product, it will come under the dog quadrant, thereby bringing you inaccurate results.

3. Determine its market share.

Now, you are required to determine the market share of the product you have chosen to analyze in the BCG Matrix. The calculation can be done very easily by the amount of revenue it generates or its actual market share. You can easily calculate it by dividing your product’s revenue or market share by the revenue or market share of your biggest rival in the market. Plot the number that you get on the X-axis.

4. Calculate the market growth rate.

Next, you are required to determine the market growth rate of the product/unit. Either study the commonly available industry reports to find out its growth rate. You can also get a rough idea by evaluating the growth of your biggest rivals. Now, leverage the data you have got to come up with future projections. The number that you have is in percentages. Use the same to plot your Y-axis.

5. Fill in the matrix

Now, complete the two-by-two grid of the BCG Matrix by filling in the necessary details. This will give you a clear idea of what to prioritize and what to discard.

Now that you have a clear idea of how to use the BCG Matrix, you need to know when you should apply the BCG Matrix to your business. The best time to do so would be when you wish to define long-term strategies for your business.

Below-mentioned are the perfect situations where you can use the BCG Matrix:

- When your business has significant market shares in different markets.

- When your business relies on high-end analysis tools to come up with strategic planning.

- When you are a well-established manufacturer.

- When your business has multiple business divisions or products.

Real-World Examples of BCG Matrix

To understand the BCG Matrix closely, here are 7 examples from our everyday life.

1. Coca-Cola

Classic Coke, the original drink by Coca-Cola, is a typical example of a “Cash Cow.” It experiences a high market share in an otherwise slow-growing market of carbonated drinks. The product is already a well-established one. So, it does not require much marketing effort. Coca-Cola is in a position to utilize the cash generated by Classic Coke to fund other related products, such as health-oriented drinks (faster-growing markets).

2. Apple- iPhone

Apple’s iPhone is a typical example of the Star category. iPhones have a high market share in a fast-growing smartphone market. Apple stays relevant by consistently adding new features to its iPhones. That’s how the iPhones retain their competitive edge in the technological market. Being the Star product, Apple requires a significant amount of investment to retain its dominance over the market.

In case the smartphone market slows down in the future, the iPhone will shift from the Star category to the Cash Cow category.

3. Amazon- Kindle

The Kindle, an e-reader, created ripples in the market with its launch. Eventually, the buzz died down, and now, Kindle comes under the dog category. As of now, Kindle has experienced a low market share in a low-growth market (e-book readers). Kindle does serve a niche market. Yet, it has other strong contenders in the line. So, Amazon is required to reduce its investment in Kindle. Eventually, organizations will decide to phase out their dog products. However, Kindle still manages to add value to Amazon’s ecosystem.

4. Google- Google Search

Google Search is the perfect example of the Cash Cow category. It experiences a dominant market share in a low-growth market (search engines). Google continues to enjoy billions in revenue through advertising, irrespective of its slow growth in search engines. The funds that Google accumulates through advertising are used in other innovative projects such as AI, Google Cloud, and so on. Google Search is a product that churns out consistent profit without requiring much of an investment.

5. Sony Playstation

Sony’s PlayStation is a premium example of the Star category in the gaming console market. The product enjoys a strong market share. Also, gaming is a high-growth market. Therefore, PlayStation is a significant brand that adds to Sony’s revenue.

The gaming industry is expected to boom in the near future. Sony keeps investing in technology, partnerships, and games in order to retain its dominance and stronghold in the market.

If the gaming industry stabilizes in the future, Sony PlayStation will slowly shift from being a Star to a Cash Cow.

6. Tesla-Model S

Tesla Model S is the perfect example of the Star category product in the EV market. It has an extremely high market share in a rapidly growing market of electronic vehicles. Tesla keeps investing in production, research, and marketing to stay ahead of its rivals. With time, it is expected that the industry will mature and eventually, Tesla’s Model S will turn into a Cash Cow.

7. PepsiCo- Tropicana

Tropicana is the orange juice brand by Pepsico. As of now, it comes under the Question Mark category. It has a low market share in a high-growth market for health drinks. Tropicana requires consistent heavy investment in order to combat strong competition from other orange-flavored health drinks.

It will need more investment to become a Star. It is completely up to Pepsico whether they can convert Tropicana into a profitable venture or not.

FAQs

1. How do companies benefit from the BCG Matrix?

Ans: The BCG Matrix enables the companies/businesses to allocate resources efficiently by:

- Deciding the perfect time to phase out.

- Recognizing high-potential products that are in need of investment.

- Identify profitable products that can help gather funds for other investments.

2. What is the meaning of Market Growth Rate in BCG Matrix?

Ans: Market Growth Rate is the indicator of how fast the market or industry is evolving or expanding. A high-growth market is one that opens up doors to opportunities. A low-growth market is one that has already reached saturation.

3. Why are Star category products important for a company?

Ans: Stars are the products that enjoy high market share in a fast-growing market. They require a heavy investment to retain their Star category. However, they have the potential to turn into a Cash Cow in the future as the market matures and stables down.

4. What is the biggest challenge faced by products under the Question Mark category?

Ans: The biggest dilemma with Question Mark products is whether to invest in them to enhance their market share or phase them out slowly. The management is required to calculate the ROI against the money and resources they keep investing in Question Mark products.

5. Is the BCG Matrix applicable only to large enterprises?

Ans: Absolutely not! It can even be used by small businesses if they have diverse product lines.

6. How can the BCG Matrix help a company grow?

Ans: The BCG Matrix helps an enterprise to make crucial decisions such as:

- Which products should be maintained (Cash Cows)

- Which products to be invested in (Stars and promising Question Marks)

- Which products to discontinue (Dogs)

7. Can a business use the BCG Matrix alongside other strategic tools?

Ans: Yes, of course! BCG Matrix can be used effectively alongside other tools such as PESTEL analysis, SWOT analysis and Porter’s Five Forces. This will give a comprehensive view of your business’s current strategic position.

8. Why do businesses decide to divest from Dog products?

Ans: Products that fall under the Dog category experience low market share in slow-growing or declining markets. Companies get a minimal return even after investing heavily in these products. So, they eventually phase out the Dog products and invest in other profitable areas.

8. How does a Cash Cow product contribute to a business?

Ans: Cash Cows are those products that are stable in nature and enjoy consistent profit in a low-growth market. They require minimal investment. However, the ROI is high, and it can be used in other high-investment areas of your business.

We have covered all the relevant details about BCG matrix -right from its definition to purpose, in this informative blog. Hope you find it handy.

- The Role of Generative AI in Business Decision-Making - March 2, 2025

- FinTech 3.0: The Next Level of Financial Innovation - March 2, 2025

- 5 Reasons Why You Should Study MBA In United States - February 13, 2025